For decades now, Taiwan, a small island nation in East Asia, has been the subject of intense rivalry between China and the United States (US). While China is shoring up its military defences to annex Taiwan and integrate it with the Chinese mainland, the US is extending economic and military aid to thwart China’s dream of integrating Taiwan, which has been present since Mao Zedong declared that the island must be unified by force if necessary.

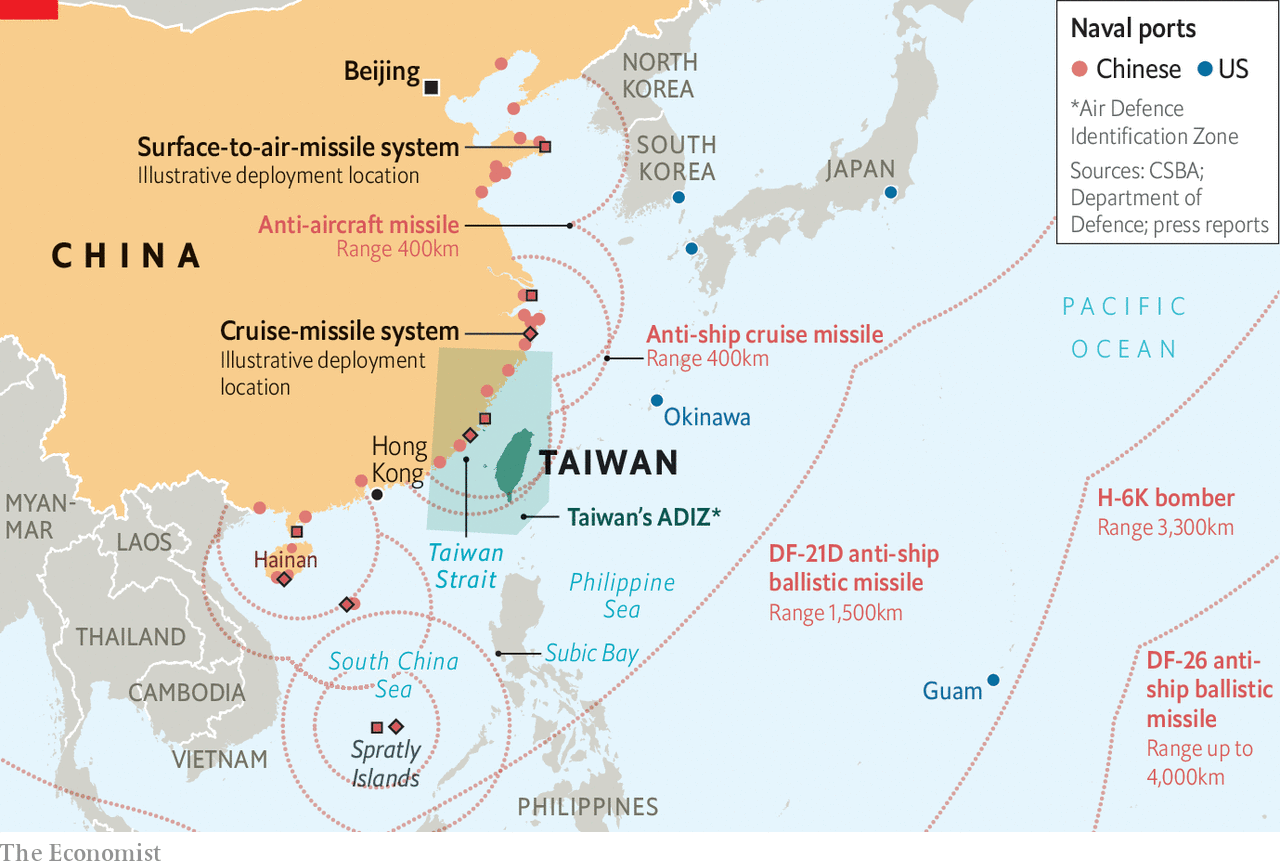

Similarly, current Chinese President Xi Jinping has also announced plans to unify Taiwan by force. To support this goal, China has upgraded its military, weapons, and artillery to rival that of the US, Beijing’s single most significant strategic threat. Though there is no definitive timeline for the Chinese invasion of Taiwan, the Communist Party (CCP) is already taking measures to intimidate the island nation, including deliberate military provocation, frequent airspace incursions, display of military prowess near Taiwan, cyberattacks, disinformation campaigns, and pressurising countries to break ties with Taiwan and recognise the island as a Chinese province.

Yet, despite its intimidatory tactics, it remains unlikely that Beijing will follow through on its threat, due in large part to Taiwan’s indispensable semiconductor sector. Semiconductors or chips are critical components that power modern civilian and military devices. They are used in automobiles, smartphones, computers, medical equipment, the internet, aircraft, fighter jets, hypersonic weaponry, etc. The demand for the product is increasing as emerging technologies such as artificial intelligence (AI), 5G, quantum computing require advanced devices enabled by semiconductors.

Taiwan’s primacy in the semiconductor sector and its role in chipmaking was cemented during the COVID-19 pandemic, during which severe disruptions to production in the automobile industry and the vulnerability of the worldwide semiconductor sector has forced manufacturers to rely on Taiwan’s near-monopoly on advanced chips.

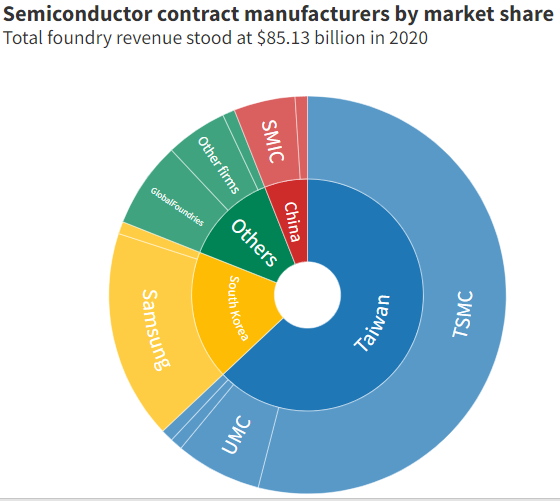

Taiwan dominates the chip market, with clients such as Apple, Qualcomm, and Nvidia. The island nation accounts for 63% of the global semiconductor market share, with an output value worth $107.53 billion. According to research firm TrendForce, Taiwan Semiconductor Manufacturing Company (TSMC) alone accounts for 54% of the global semiconductor market share. In addition, TSMC is responsible for 92% of the world’s production of advanced chips.

The TSMC is in demand because the Taiwanese firm and its South Korean counterpart, Samsung, are the only companies capable of manufacturing the most advanced 5-manometer chips. Currently, TSMC is the major supplier in the global market of chips below 10 nanometers; it accounted for 84% of pure foundry revenue in 2020. In comparison, its nearest competitor Samsung accounted for 14% of the pure foundry revenue in the same year.

Taking stock of this disparity, a technology analyst with research firm Gavekal Dan Wang has said, “So TSMC, if you just have a look at market share, I believe manufactures around 50% of all semiconductors in the world. And I think that still understates how important it is, because these are some of the most advanced chips out there.”

Taiwan’s monopoly has made it indispensable to both the US and China, as neither possess the capacity to produce their own advanced semiconductors. To this effect, the island nation’s semiconductor sector acts as a “silicon shield” against Chinese invasion and virtually guarantees US support against Chinese aggression.

The Taiwanese government, too, is acutely aware of the value of the industry. In September of last year, Taiwan’s Economy Minister, Wang Mei-Hua, ackonowledged, “This isn’t just about our economic safety. It appears to be connected to our national security, too.”

According to an October 2020 report from the Congressional Research Service, China makes up for 60% of world semiconductor demand, of which 90% is imported or manufactured locally by foreign suppliers, including Taiwan. In the first quarter of 2021, almost half of Taiwan’s exports to China were semiconductors. Furthermore, Huawei, which is widely believed to have links to the Chinese government, was reportedly the TSMC’s second-largest customer in 2020, relying on the company for chips below 10-nanometers.

However, the TSMC severed ties with Huawei in May 2020 after the US Department of Commerce placed restrictions on the Chinese tech giant due to security concerns. During Trump’s presidency, the US administration also blacklisted Beijing’s largest chipmaker, SMIC, effectively restricting the company from accessing the technology and machinery required from the US and its allies. The US also allegedly pressured Dutch tech company ASML to not ship crucial components that would help SMIC compete with its rivals.

Furthermore, a group of 42 nations willingly entered into a voluntary export control agreement—the Wassenaar Agreement—to limit technology sharing with dual-use applications (i.e. technology that can be used for both civilian and military purposes). With the agreement, the US and its allies secured control over the export of chip technology to China.

Given this hostility between China and the US and the world’s apparent over-reliance on Taiwan, Beijing has made significant overtures to become more self-reliant. Last year, China announced a five-year development plan to become self-sufficient in science and technology. Under the five-year plan, China outlined an increased expenditure of more than 7% every year on research and development between 2021 and 2025 to attain significant technological breakthroughs. In particular, China said it would focus on research and development in integrated circuit design tools, and key equipment and materials.

However, it is still years away from attaining the expertise and capacity to become self-reliant in the semiconductor industry. In this respect, China’s enduring trade war with the US, which has resulted in severe restrictions on its access to advanced technology and equipment, has left Beijing with few options but to invade Taiwan. That being said, such an invasion comes with more risks than China may be willing to take, as the TSMC’s facilities and headquarters are located along the coast facing China and are in the range of Chinese missile attacks.

Even if they seize the facilities intact and acquire foreign technology, China would be cut off from the global supply chain essential for production, as the majority of the equipment and tools needed for the production of chips are imported from the US and Japan. In 2020, importing semiconductor equipment from these two nations cost Taiwan $18.3 billion and accounted for 6.3% of Taiwan’s total imports.

Furthermore, integrated circuit (IC) fabrication is a complex process that requires a tightly controlled environment, very specific equipment, and expertise to manipulate particles at a sub-atomic level. As things stand, China lacks the experience to run such a mega-operation requiring immense knowledge and expert technical skill. Therefore, even if it were to invade Taiwan, China would still have to rely on highly-skilled Taiwanese workers to operate the facilities.

Taking all of this into consideration, it is clear that Taiwan’s semiconductor industry has given it a layer of, as things stand, impenetrability against a Chinese invasion. At the same time, Taiwan’s economic indispensability has also resulted in the US providing advanced military weapons, conducting drills with the Taiwanese army, and aiding Taiwan to counter Chinese cyberattacks aimed at TSMC’s facilities. Regardless of the questionability of the US’ self-proclaimed values-based motives for protecting Taiwan and opposing China, what is clear is that Taiwan is benefiting from the US having deemed the island nation’s freedom to be crucial.

Ultimately, invading Taiwan presents a catch-22 situation to China, as it neither guarantees control over chip production nor ensures the stability of the supply chain. And if China does not invade Taiwan, it could potentially lose the tech war with the US, since it currently lacks the technology and expertise to indigenously produce the amount and quality required for advanced technology and military devices.