The European Central Bank (ECB) on Wednesday predicted the impending downfall of Bitcoin, the world’s most popular and valuable cryptocurrency.

In a blog post on the bank’s website, ECB Director-General Ulrich Bindseil and adviser Jürgen Schaaf claimed that Bitcoin is on “the road to irrelevance” owing to the ongoing turmoil in the cryptocurrency market.

They noted that Bitcoin’s tendency to fluctuate sharply meant that the currency could not be entirely trusted and while its recent stabilisation might come as a relief to the virtual currency’s proponents, it is in its throes and is a “last gasp” away from extinction.

They were referring to the volatility of the cryptocurrencies like Bitcoin, which was valued at around $18,000 in 2018 and crashed to $3,000 the following year. Similarly, while its value jumped to a record $65,000 in November 2021, it was trading at around $24,000 in August.

Following the recent crisis in the cryptocurrency universe, Bitcoin’s value further plunged to $16,000 today. This poor performance is in part due to the recent collapse of United States-based cryptocurrency exchange FTX, which failed to pay over $8 billion in liabilities to customers who had deposited their cryptocurrency investments.

FTX and its founder Sam Bankman-Fried, worth $10.5 billion in October, have filed for bankruptcy. The collapse of FTX has plunged Bankman-Fried’s net worth by almost 94% and has sent shockwaves throughout the cryptocurrency market, with customer confidence in cryptocurrency sharply dropping.

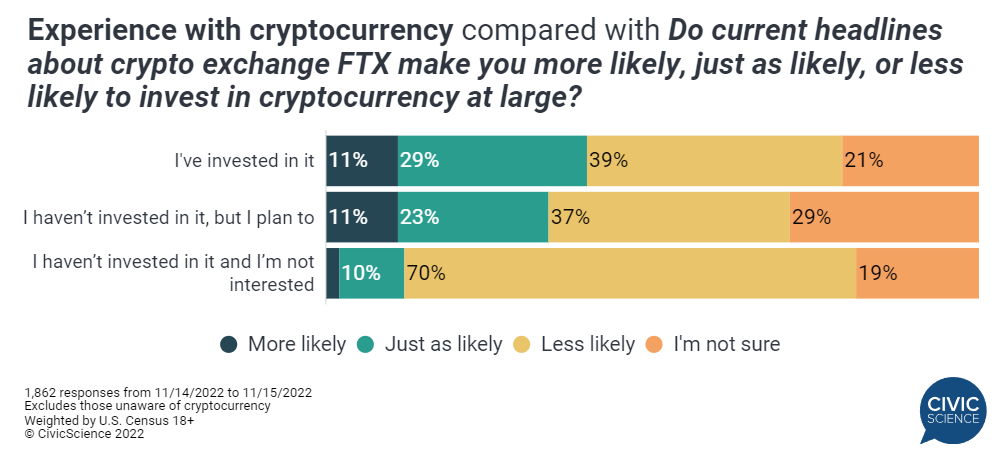

A study published after FTX collapsed showed that nearly 40% of US adults who had invested in cryptocurrencies are less likely to do so in the future. This loss in trust is being propelled by people experiencing personal loss from the FTX collapse or knowing someone who experienced a loss.

Against this backdrop, Bindseil and Schaaf argue that cryptocurrencies, particularly Bitcoin, are “speculative bubbles” that rely on new money and new investments, making fresh investors susceptible to manipulations. Moreover, they dismiss the claim that cryptocurrencies will bring great societal transformations in the future.

They note that cryptocurrencies have so far “created limited value for society,” which is why governments have been reluctant to regulate the market. In this respect, the authors call for greater industry regulation and urge investors to be cautious of investments in cryptocurrencies.

The blog post notes that Bitcoin is also an “unprecedented polluter” that “consumes energy on the scale of entire economies” and “produces mountains of hardware waste.” Global Bitcoin mining is estimated to consume 89 Terra Watt hours (TWh) per year, higher than the electricity consumed by Belgium and Finland. If ranked among countries with the highest electricity consumption rates, Bitcoin would grab the 36th spot.

Against this backdrop, the authors call on governments to regulate Bitcoin and warn financial institutions against promoting Bitcoin as a suitable payment system. “The negative impact on customer relations and the reputational damage to the entire industry could be enormous once Bitcoin investors will have made further losses,” they conclude.

Earlier this year, the United Nations warned that if cryptocurrencies are not regulated, terrorist organisations could use them to finance illicit activities, urging countries to take measures aimed at preventing terrorists from using virtual currencies.

Moreover, there have been calls for caution before adopting Bitcoin as a mode of payment, given that El Salvador’s adoption of the currency has not gone well. Last year, the El Salvador government made Bitcoin legal tender, a move that mandated economic agents to accept Bitcoin as a mode of payment and purchased over 2,000 Bitcoins worth over $103 million at the time. Today, Bitcoin’s plummeting value has reduced El Salvador’s Bitcoin purchases by over 50%, dealing a major loss to Salvadorans who have accumulated their wealth in Bitcoins.